The Triple Threat to Home Staging

When it comes to selling your home, not all rooms are created equal. In fact, there are three spaces that buyers pay the most attention to. And if you get them right, you’re more likely to secure top dollar for your property. According to the 2025 National Association of REALTORS® Profile of Home

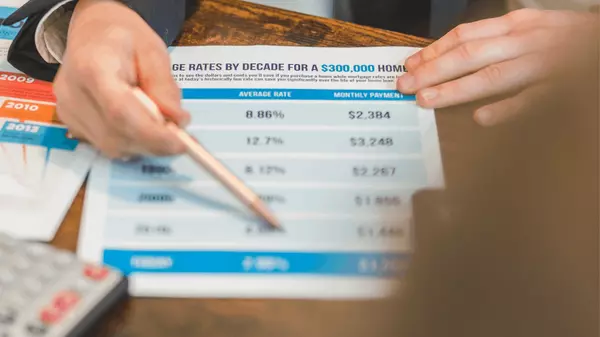

Worried About the Economy? Here’s What It Means for Homebuyers

A shrinking economy. Rising mortgage rates. Flatlining prices. If you’ve been thinking about buying a home in 2025, it’s no wonder you’re feeling hesitant. For many buyers, the instinct right now is to wait it out. To see what happens before making a big move. And the headlines don’t help: The U

The Housing Affordability Report Card: How Arizona Stacks Up

Spoiler alert: Housing affordability isn’t as simple as the headlines make it sound. Depending on who you ask, the real issue isn’t just home prices, or even the number of homes on the market. It’s about access. It’s about opportunity. And most of all, it’s about what affordable really means f

Is It Too Late to Buy Your First Home? Not Even Close.

Buying your first home doesn’t look anything like it did 30 years ago. The average first-time buyer in 2024 is 38 years old. Compare that to 33 in 2020 and 31 between 1993 and 2018. So if you’re renting in your 30s or 40s, it’s easy to wonder: Did I miss my window? The short answer is not at all.

Categories

Recent Posts