The Best Ways to Give Real Estate to Your Kids

So your kid wants to buy a home, and you're thinking about stepping in to help. Good news: you’re not alone. Bad news: doing it wrong can trigger taxes, tension, or both. Today’s first-time buyers are facing a combo of sky-high prices and interest rates that just won’t quit. The typical down

Warren Buffett Analysts Call This Trend a Housing Goldmine

Imagine this: You walk through the front door after work. Your dad is teaching your daughter how to make his famous pasta sauce in the kitchen. Your mom is watering plants on the patio. Upstairs, your brother’s finishing up a Zoom call from his home office. Sound a little chaotic? Maybe. But for m

5 Costly Mistakes Homeowners Make When Selling Their Home

If you’re thinking about selling your home, there’s a good chance you’ve already asked yourself the big question: What’s it worth? But the better question might be: What will it actually sell for? The truth is, how much money you walk away with doesn’t just depend on your home's condition or your

How to Buy a Home Without Blowing Your Budget

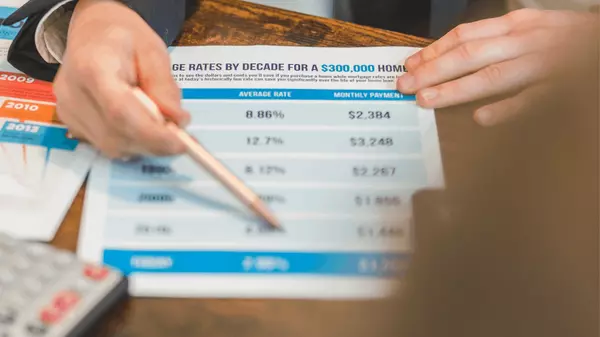

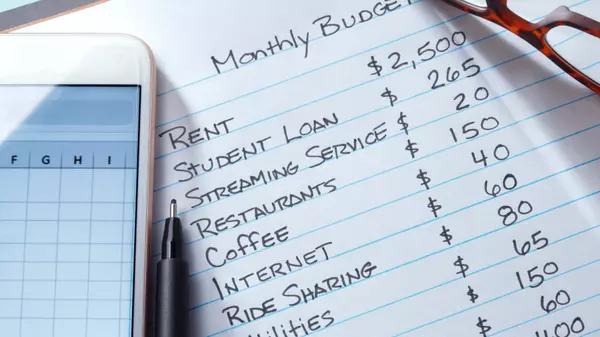

For decades, buyers have been told to follow one simple rule: Don’t spend more than 30% of your income on housing. That is the gold standard. The budget benchmark. The line in the sand between “affordable” and “overextended.” But in 2025, that line no longer seems attainable. According to a Realto

Categories

Recent Posts