The $27,000 Real Estate Gap: What Buyers and Sellers Need to Know

If you're planning to buy or sell a home in 2025, there's something you should know: buyers and sellers aren't seeing eye to eye on price.

According to a recent survey by Clever Real Estate, there's a $27,000 gap between what buyers think they’ll pay and what sellers expect to get. Buyers are budgeting an average of $386,507, while sellers are eyeing $413,976.

So, what’s behind this pricing mismatch, and what does it mean for you? Let’s break it down.

What’s Driving the Pricing Gap?

The $27,000 gap is rooted in how buyers and sellers view the market.

1. Sellers Are Riding High on Confidence

After years of rising home prices, sellers are entering 2025 feeling pretty good. Nearly three-quarters (74%) of sellers believe their property will sell at or above the asking price—but as market conditions stabilize, this isn’t always the case in today’s market. This confidence can lead sellers to set prices higher than buyers are willing to pay.

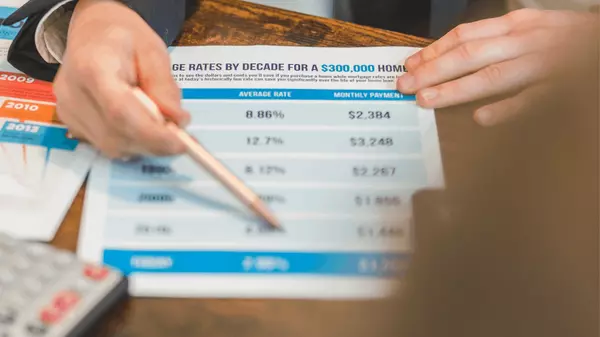

2. Buyers are Facing Budget Constraints

Buyers, on the other hand, are grappling with rising mortgage rates and affordability challenges. Nearly two-thirds of buyers (68%) worry that escalating home prices will delay their purchases.

With budgets stretched thin, buyers may hesitate to meet seller expectations, leading to prolonged negotiations or missed opportunities.

3. Market Trends

The majority of buyers and sellers (87%) expect strong demand in 2025, but housing economists are predicting [link to this blog, if published] smaller price increases than in years past. That’s great news for buyers looking for stability—but it might mean sellers need to adjust their expectations.

How Buyers Can Navigate the Gap

If you’re buying a home, that $27,000 gap might feel daunting—but don’t worry. There are smart ways to navigate it:

- Know the Market: Research local home prices so you’re prepared to make competitive offers. Understanding where sellers are coming from can give you an edge in negotiations.

- Be Ready to Compromise: While you might not want to pay full asking price, being flexible on other terms—like closing dates—can help you stand out.

- Leverage Market Stabilization: While home prices are still rising, the pace is slowing, with many agents predicting increases in the single digits in 2025. This could create opportunities for buyers to negotiate more effectively.

How Sellers Can Attract the Right Offers

Sellers, if you’re looking to get top dollar, it’s all about setting the stage and pricing strategically. Here’s how:

- Price it Right: Work with a local agent to set a price that reflects market conditions. Almost half of agents (49%) say pricing is the most important factor in selling a home quickly.

- Make Your Home Shine: A little extra effort in staging or professional photos can go a long way in justifying your price.

- Be Open to Negotiation: While it’s tempting to hold out for a dream offer, being flexible can help you close faster and avoid long delays.

What It Means for the 2025 Market

The pricing gap tells us a lot about the dynamics of the 2025 housing market. Sellers are optimistic, and buyers are cautious. The challenge? Bridging that $27,000 gap in a way that works for both sides.

For buyers, it’s about being prepared and realistic about what you can afford. For sellers, it’s about understanding the current market and pricing your home to attract serious buyers. With a little give-and-take, both sides can find success.

TL;DR

- Home buyers expect to spend $386,507 on average, while sellers are aiming for $413,976—a $27,000 price gap.

- Rising costs have buyers cautious, while sellers are confident they’ll sell at or above asking price.

- Navigating this gap takes strategy—whether you’re buying, selling, or negotiating.

So, are you ready to take on 2025? Let’s bridge that gap together!

Categories

Recent Posts

GET MORE INFORMATION