Move to Bullhead City, AZ

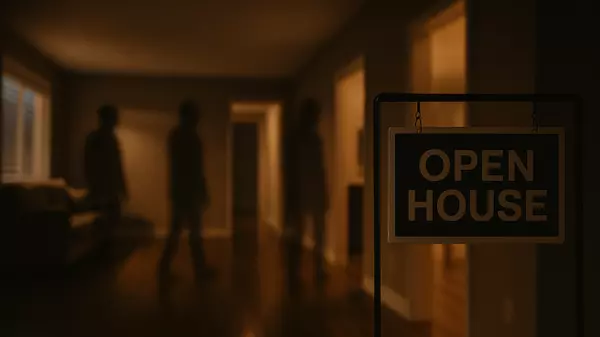

Seamless Relocation Services to Bullhead City, Fort Mohave, Golden Valley and all of Mohave County!

GET YOUR HOME VALUATION REPORT FOR FREE!

Find out the the value of your home!

Hi, I’m Alicia!

I began my real estate career in 2021 in my beautiful home state of Colorado before moving south to enjoy the sunshine and lifestyle of Arizona. I’m passionate about helping people find the perfect place to call home—whether it’s your first, your forever, or somewhere in between. While I proudly serve Arizona, I maintain strong connections to assist buyers and sellers in Colorado, Nevada, and beyond. Outside of real estate, you’ll find me enjoying family time, exploring the outdoors, and embracing every new adventure.

3707 E Southern Ave, AZ, 86442, USA

https://aliciamcconnelhomes.com/No Obligation Full Market Value Cash Offers!

My new home selling program allows homeowners to sell with no showings, choose the close date, and ensure a full market value sales price! We can even fix it up and you get all of the additional profit! Just click the link below and enter the details of your home to unlock cash offers.